Core Solution

S T O R M : Synpulse x Thought Machine Operating Requirements Model

Accelerate your digital banking journey from value proposition to operationsalisation with a combination of the best of product excellence and process efficiency.

Reach your vision with Synpulse8

Changing market demands, revenue pressures, tighter regulations and increasing competition from digital entrants mean that digital transformation and developing a frictionless bank is now essential to remain competitive.

STORM, or the Synpulse x Thought Machine Operating Requirements Model, combines Synpulse’s in-depth expertise in target operating models and strategies for banks together with the powerful core banking capabilities of Thought Machine’s Vault platform.

In unison, STORM supports our banking clients in their digital transformation journey.

The issue with digital transformation

Some issues both traditional banks and new banking players tend to overlook when embarking on their digital transformation projects include:

Not following a customer-centric apporach

Failure to have a strategic long-term process and product roadmap

Failing to upgrade from legacy banking systems and technology

Inability to automate internal and external banking processes

Not following a lean and agile product development cycle

Seamless integrations and reduced time to market

STORM focuses on the following key areas to successfully deliver a bank’s digital modernisation goals:

An industralised Core Banking System (CBS) implementation approach

Architecture design to address challenges faced by the client

Business-friendly workshop approach

Strong governance throughout project lifecycle

Reduction in time-to-market and cost savings during implementation

Who we serve

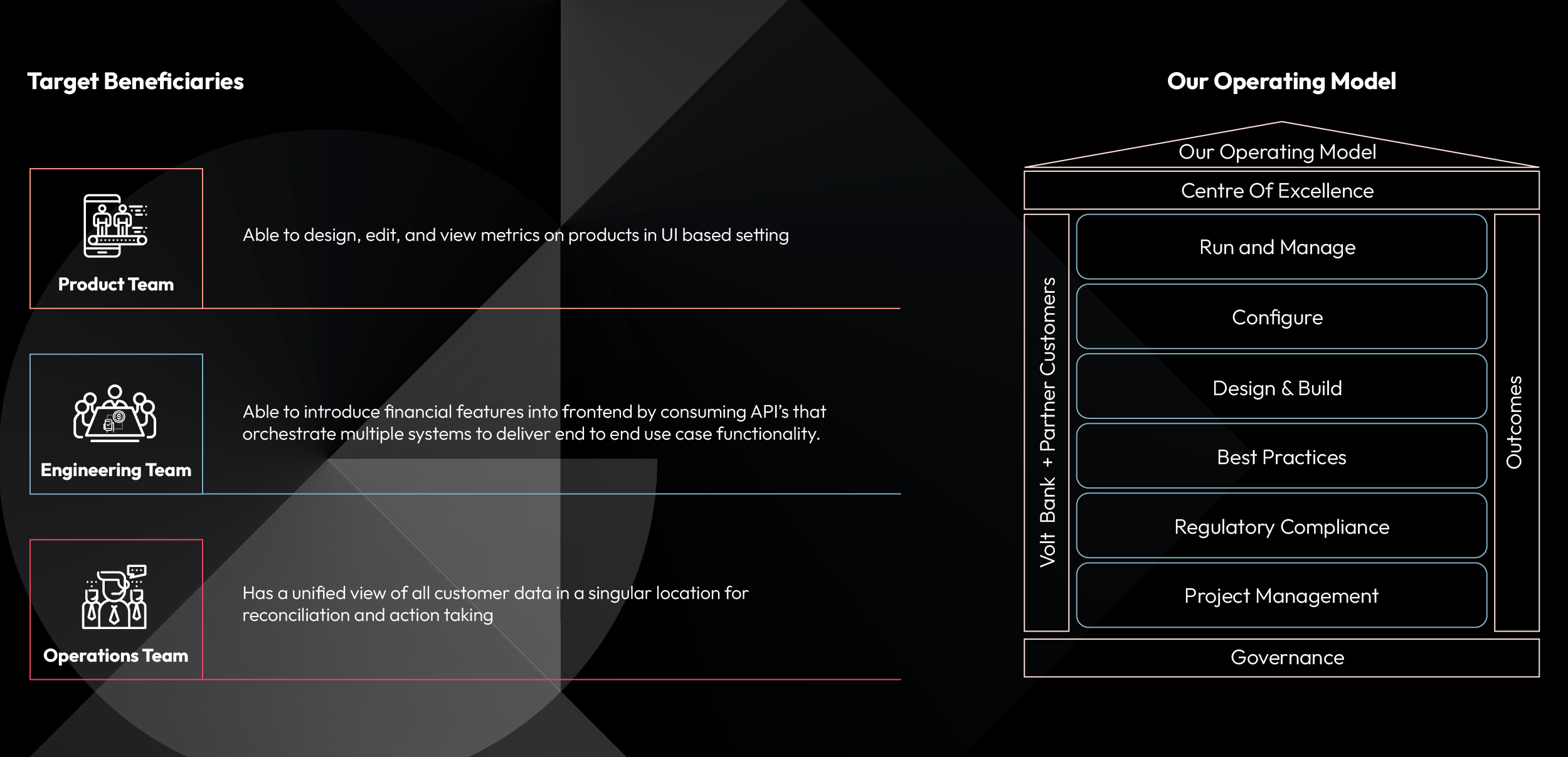

STORM combines a Target Operating Model and strategy, which are uniquely curated for digital banks of all shapes and sizes, with Thought Machine’s Vault as the core banking service provider and Synpulse as the strategic delivery partner.

Methodology

The model lays down 100 baseline processes that are required to set up a new digital bank and maps them to seamlessly integrate with Thought Machine’s Vault.

Value proposition

Banks can see a 35% reduction in time to market when they implement STORM in comparison to a standard approach, resulting in substantial cost savings for the bank.

Usability

The outlined processes are designed such that multiple banking stakeholders (e.g., business developers, interface SMEs, data SMEs) can analyse, adopt and build on top of them innovatively yet effortlessly.

Team structure

True to our commitment to enable banks to get the best out of Vault, we are ready to deploy an army of Vault-ready engineers and consultants to play a key role in implementing and integrating Vault efficiently and effectively.