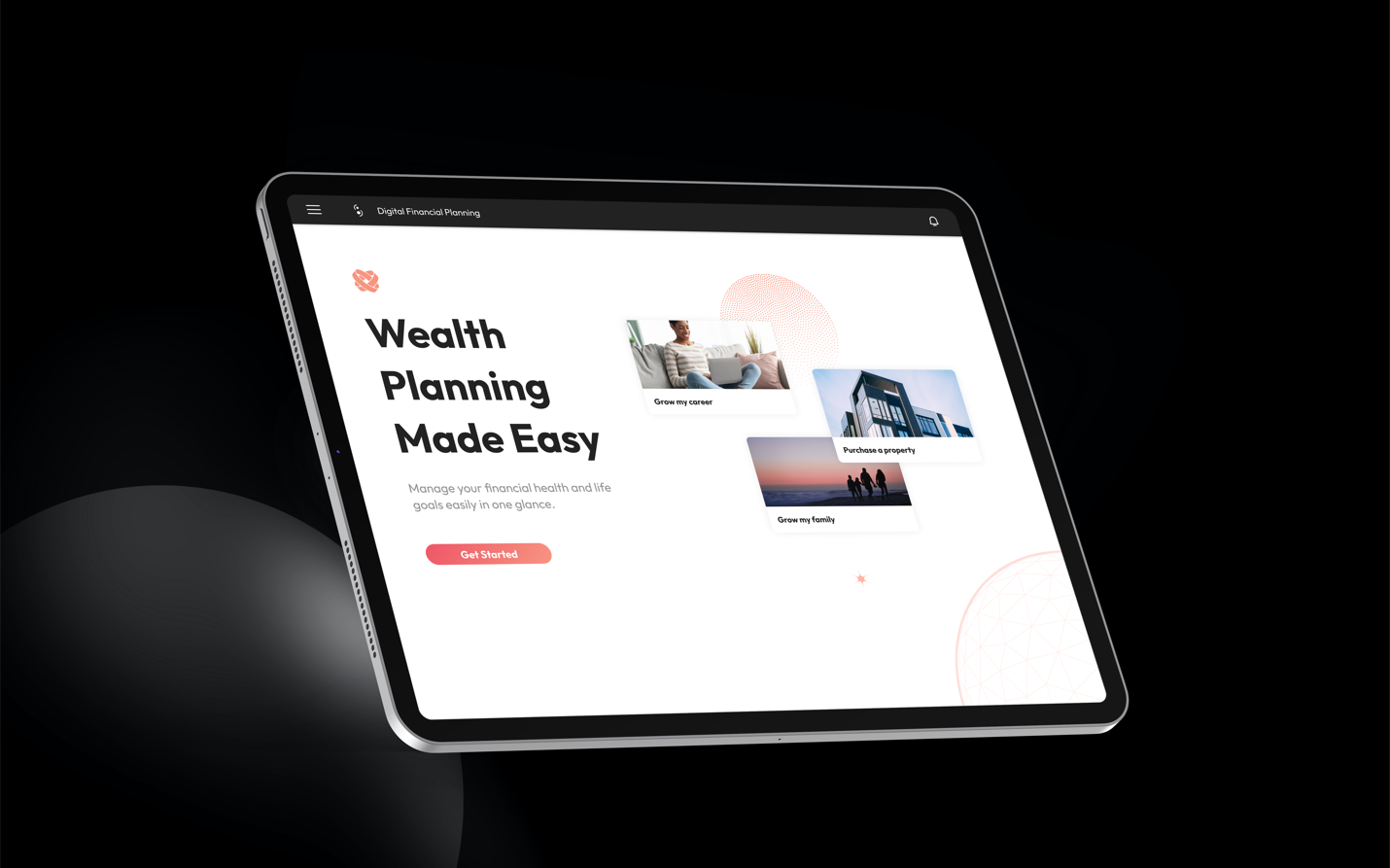

Digital Financial Planning

Digitalising the Financial Planning Journey

Case Study Client

Wealth Management Institution and Insurance Company

Objective

To digitalise the financial planning journey of our client with interactive visualisations that enable customers to understand their financial status holistically, and easily explore the different financial options available to best achieve their financial goals.

The Why: Problems

The traditional financial planning process requires customers to answer a long list of questions. The process, which is often tedious and complex, heavily relies on the static information and best guesses provided by the customers. The lack of flexibility to provide a more dynamic assessment often leads to inaccurate and unreliable results.

It was time to revamp the journey and provide the best-in-class financial planning service to our client’s customers.

The How: Solutions

Our teams revamped the financial planning journey by:

Mapping out the customer journey for different personas to identify potential gaps

Implementing the digital financial planning solutions, and integrating them within existing sales journeys

Enabling the digital financial planning services across different sales channels

Ensuring the business readiness to implement the changes and realise the benefits

The What: Outcomes

The benefits of the digital financial planning solution include:

Removed inherent complexities but enabled transparency in financial planning

Allowed customers to explore all aspects of their life plans

Provided customers a holistic financial plan in an intuitive and interactive way

Enabled up-selling and cross-selling in the sales journey

Strengthened the customer engagement through ongoing tracking.