Transform Underwriting with a

GenAI-Powered Modular Solution

GenAI-Powered Modular Solution

Reinvent efficiency with the Reinsurance Underwriting Workbench (ReUWB). It consolidates intricate processes into one single platform, streamlining the entire underwriting process. Engineered to integrate flawlessly with your existing internal systems and external data sources, this scalable solution revolutionises underwriting operations.

Powered by PULSE8, our platform automates manual data entry, captures all actions and decisions, and creates a comprehensive data log for analytics, auditing, and other relevant data for informed decision-making.

Powered by PULSE8, our platform automates manual data entry, captures all actions and decisions, and creates a comprehensive data log for analytics, auditing, and other relevant data for informed decision-making.

Trusted and recognised by the industry

Transform Underwriting with a GenAI-Powered Modular Solution

Reinvent efficiency with the Reinsurance Underwriting Workbench (ReUWB). It consolidates intricate processes into one single platform, streamlining the entire underwriting process. Engineered to integrate flawlessly with your existing internal systems and external data sources, this scalable solution revolutionises underwriting operations.

Powered by PULSE8, our platform automates manual data entry, captures all actions and decisions, and creates a comprehensive data log for analytics, auditing, and other relevant data for informed decision-making.

Powered by PULSE8, our platform automates manual data entry, captures all actions and decisions, and creates a comprehensive data log for analytics, auditing, and other relevant data for informed decision-making.

Trusted and recognised

by the industry

by the industry

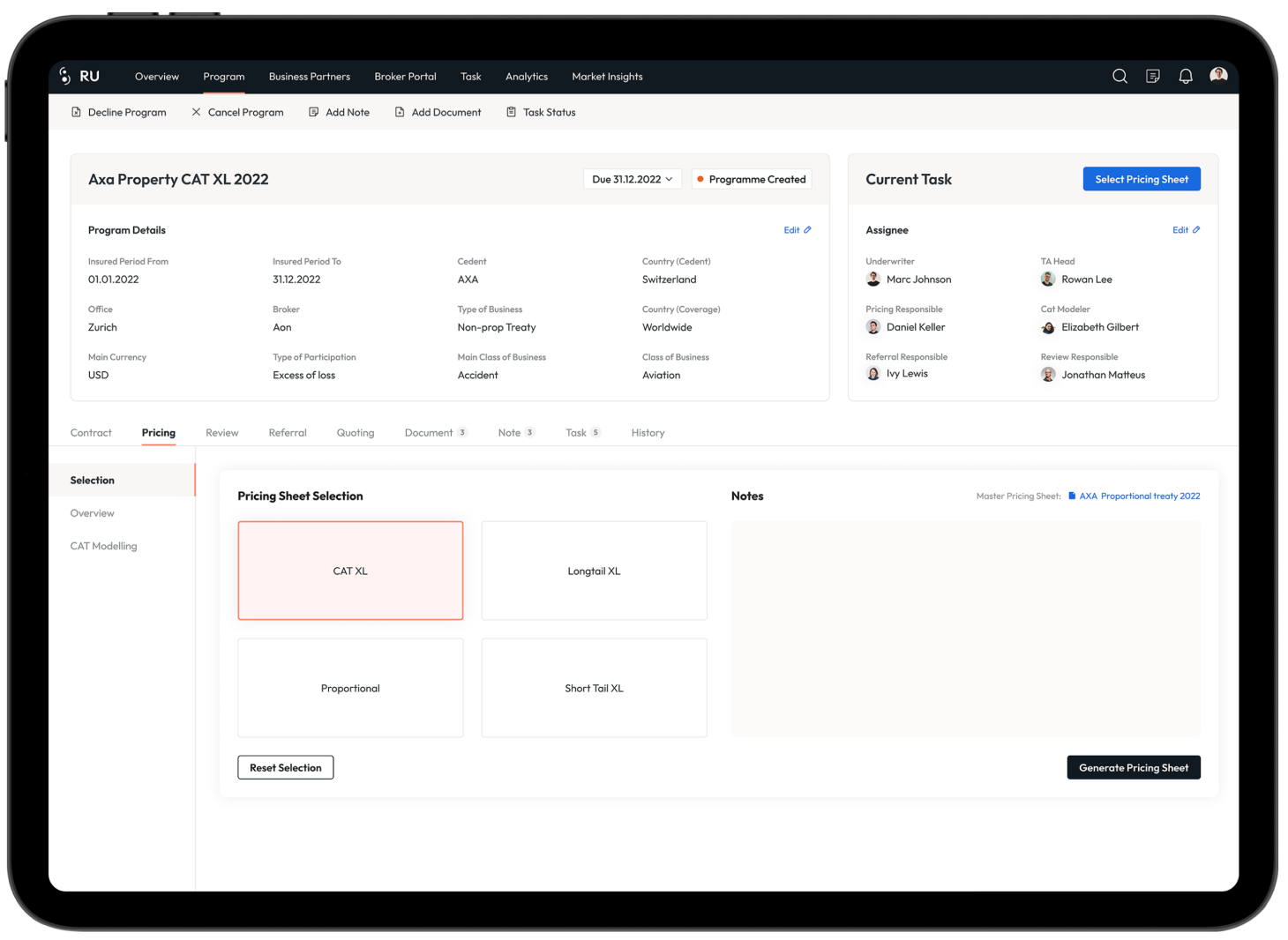

Your central hub for submissions

Centralise all your submissions, regardless of source and status, with seamless integration to tools like Outlook or your core system. Connect effortlessly with partners via ReUWB, enabling smooth market connectivity.

GenAI-powered data ingestion

Automate the data ingestion process directly from emails, enhancing operational efficiency and minimising errors caused by manual copies of your data. Reduce your submission entry time by up to 80%, streamlining workflows and improving accuracy.

Smart triaging for submissions

Detect guideline breaches early in the process, allowing you to focus on relevant submissions that match your portfolio preferences. Empower your underwriters by integrating guidelines and providing portfolio context to ensure informed decision-making.

Smart referral automation

Automate referral checks against guidelines and line guide authorities at key process points. Centrally manage rules within ReUWB to enhance compliance and reduce underwriting referral time to under an hour.

Streamlined wording comparison

Streamline your year-on-year comparisons. Automatically highlight differences in wordings, programme structures,

and more to reduce human errors significantly. This saves

you hours of manual review.

Make smarter, data-driven decisions and innovate with ease

Make smarter, data-driven decisions and innovate with ease

Our capabilities

Show All

Smart triaging

Through automated triaging, our platform ingests data from various sources like broker portals and email providers to provide a clear overview of incoming business. This streamlines submissions and enhances collaboration with brokers and cedents. System-driven checks against UW guidelines at this early stage ensure compliance and focus on business that

aligns with your target portfolio

Data ingestion

Our data ingestion module automates the extraction of treaty information from slips and other relevant documents. By reducing manual efforts and minimising errors, this feature streamlines the data ingestion process, enhancing overall efficiency and accuracy

Portfolio steering

Enhance your underwriting performance with KPI-driven portfolio steering. Utilise key metrics to monitor portfolio health, identify trends, and guide decision-making, while maintaining a comprehensive view of your portfolio dynamics

Outlook and broker portal integration

Streamline treaty management with seamless integrations. Ingest broker-placed treaties through the broker portal and automate the offer, bind, and decline process via Outlook, enhancing efficiency and collaboration