Automated Cash Pairing

Eliminates Inefficient

Manual Processes

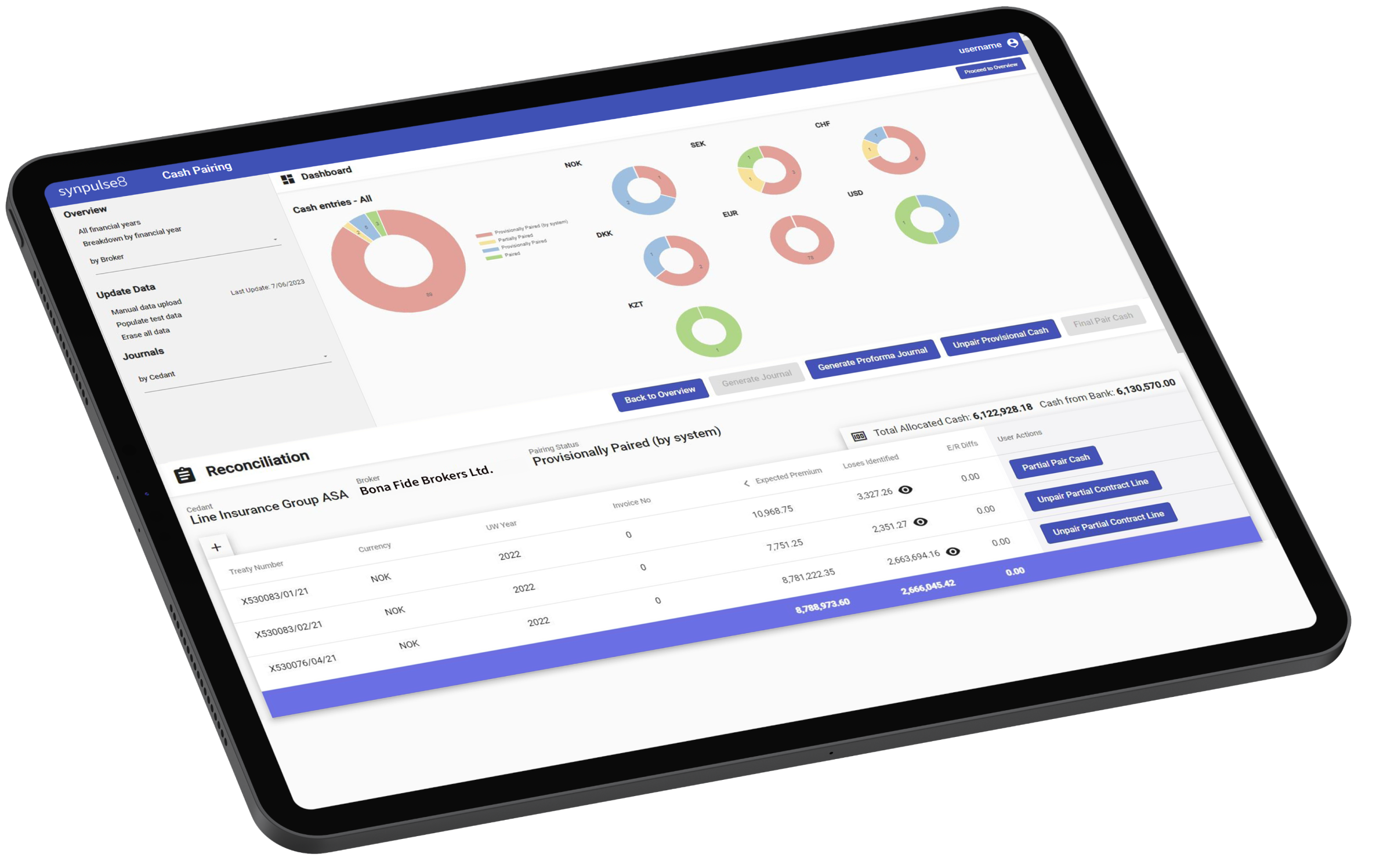

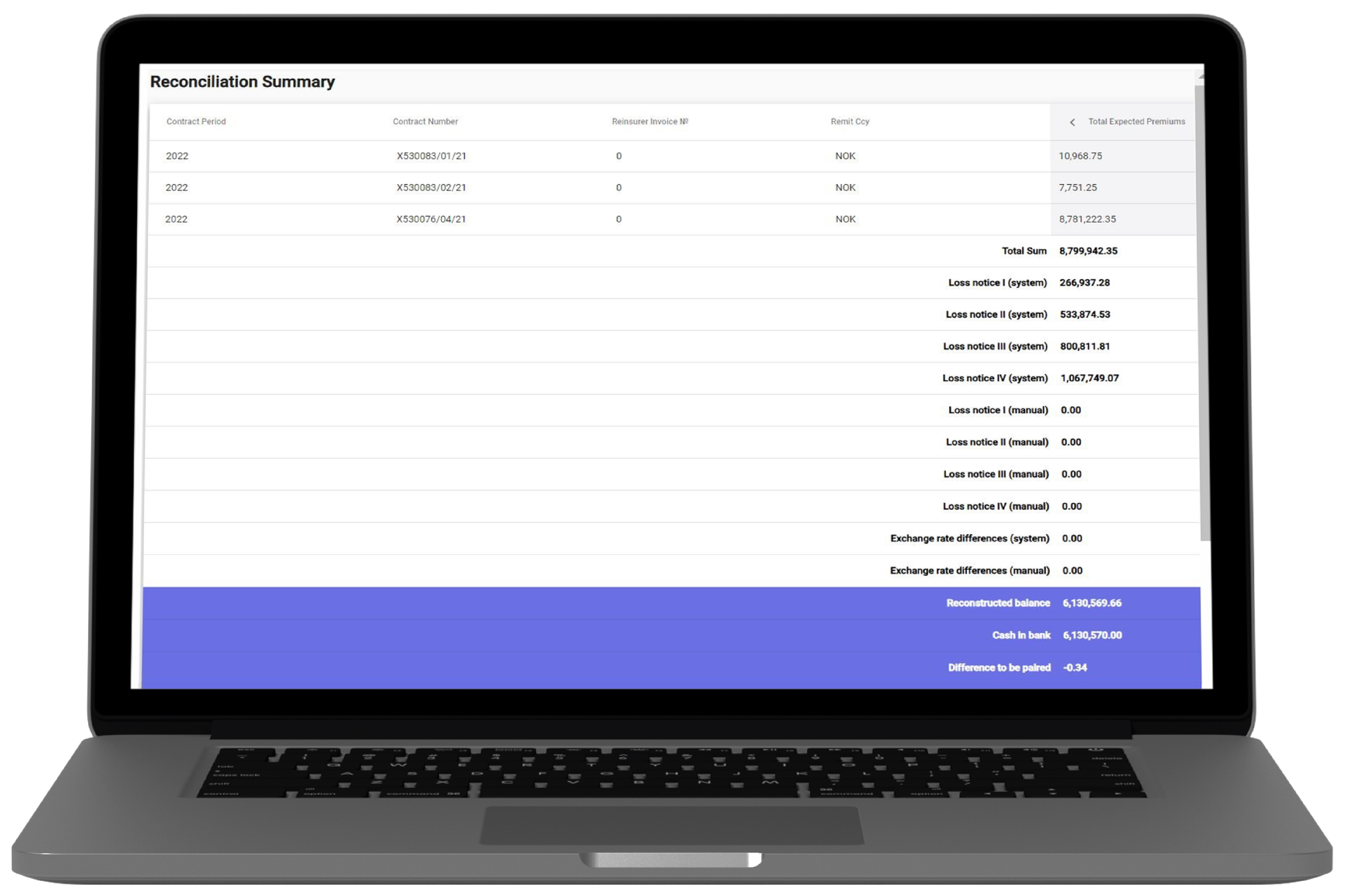

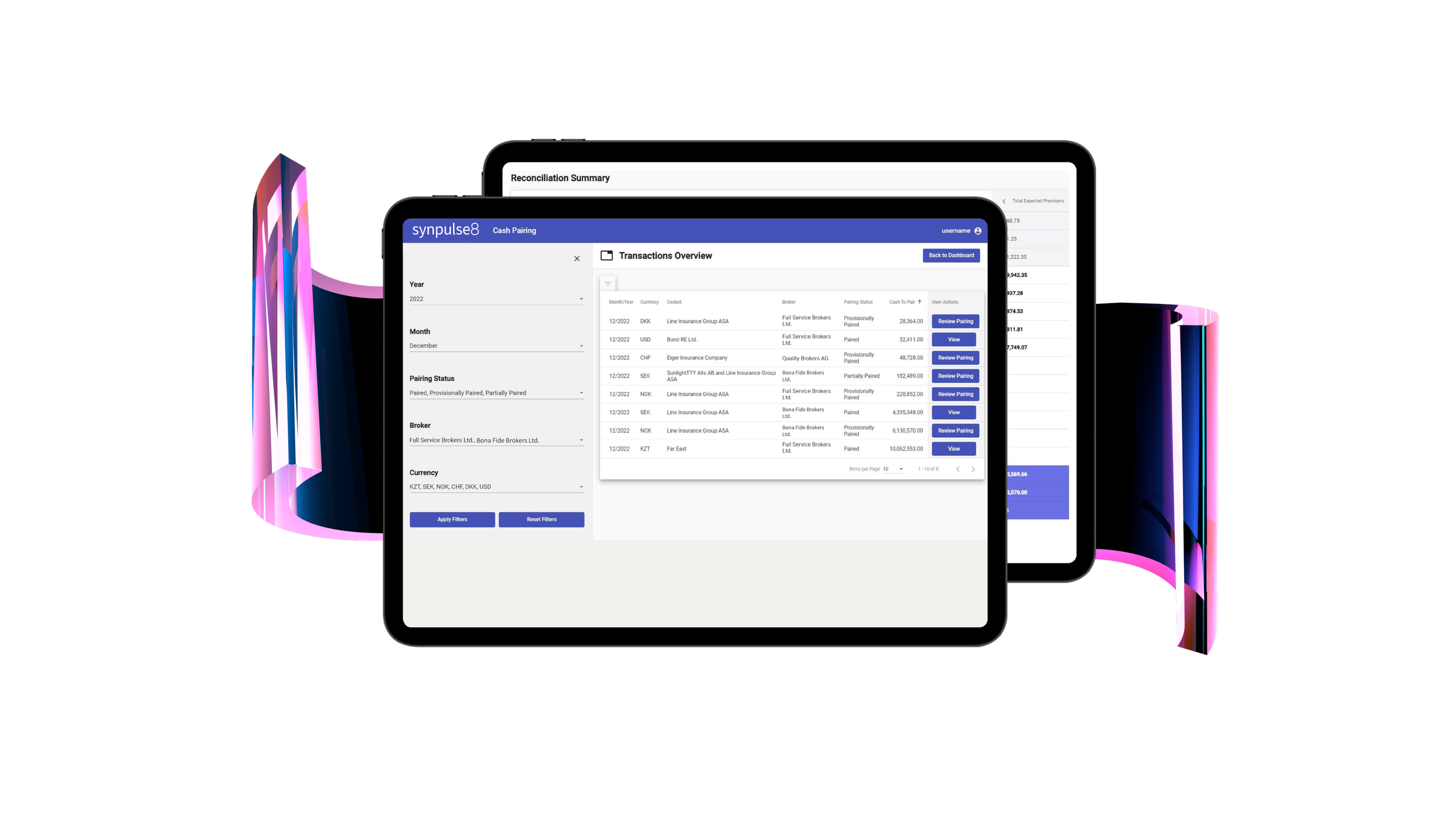

Remove the burden of clearing and settling funds with automated Cash Pairing. Our system effortlessly dissects incoming net cash, identifies its place within your reinsurance cash flow, and intelligently allocates it across multiple contracts. That's not all— it goes the extra mile by automatically constructing a sleek digital statement of accounts.

Get a demoAutomated Cash Pairing Eliminates Inefficient Manual Processes

Remove the burden of clearing and settling funds with automated Cash Pairing. Our system effortlessly dissects incoming net cash, identifies its place within your reinsurance cash flow, and intelligently allocates it across multiple contracts. That's not all— it goes the extra mile by automatically constructing a sleek digital statement of accounts.

Get a demoEvolve from manual processes to enhance operational efficiency

When technical accounting resources are spent manually clearing and reconciling various cash sources, this causes operational inefficacies that can negatively impact your business in the future.

Reduced transparency in reinsurance processes

The reinsurance process often suffers from a lack of transparency caused by brokers providing inadequate or incomplete statements of accounts. This creates a challenging situation for reinsurers as they struggle to gain a clear understanding of incoming cash flow.

Problems with unpaired cash

Unpaired cash creates complications in the reinsurance process, which can lead to inflated receivables, inaccurate liquidity management, and heightened audit and regulatory scrutiny.

Evolve from manual processes to enhance operational efficiency

When technical accounting resources are spent manually clearing and reconciling various cash sources, this causes operational inefficacies that can negatively impact your business in the future.

Reduced transparency in reinsurance processes

The reinsurance process often suffers from a lack of transparency caused by brokers providing inadequate or incomplete statements of accounts. This creates a challenging situation for reinsurers as they struggle to gain a clear understanding of incoming cash flow.

Problems with unpaired cash

Unpaired cash creates complications in the reinsurance process, which can lead to inflated receivables, inaccurate liquidity management, and heightened audit and regulatory scrutiny.

The Cash Pairing Solution

Our automated solution alleviates operational bottlenecks

Optimise your accounting teams and reallocate freed up capital while avoiding duplicate claims payouts.

Get a demoThe Cash Pairing Solution

Our automated solution alleviates operational bottlenecks

Optimise your accounting teams and reallocate freed up capital while avoiding duplicate claims payouts.

Achieve operational efficiency

Cash Pairing enables technical accounting and back-office teams to achieve efficiency gains and save time, by effectively clearing current and backed-up cash transactions.

Accelerate financial transactions

Claims payouts and premiums are settled accurately and in a timely manner, ensuring precision and promptness in financial transactions.

Drive informed decisions

Our system enables accurate reporting of financial, risk, and treasury-related information, providing reliable and up-to-date insights for decision-making.

Stay ahead of audits

Achieve clean audits and avoid regulatory issues, ensuring compliance with relevant regulations and maintain a transparent and compliant financial environment.