Loading Insight...

Insights

Insights

Reinsurers face the daunting task of managing cash receipts and pairing them with premium receivables. This often results in a buildup of unprocessed, unpaired cash on their balance sheets, causing operational headaches. In this article, we explore how our innovative technology-driven smart Cash Pairing solution can tackle these challenges.

Pairing cash with premium receivables promptly and accurately has always been a perennial pain point for reinsurers. When left unattended, the volumes of unpaired cash and corresponding receivable assets can quickly pile up, spiral out of control, and cause a headache for reinsurers.

Timely, accurate settlement of cash receipts, paired with expected premium receivables, stands as a pillar of effective cash management. Yet, reinsurers often struggle to manage this critical aspect, leading all too often to unreconciled and unpaired cash waiting to be processed, piling up on their balance sheets. This causes a plethora of issues, from unsatisfactory customer service to increased scrutiny from regulators. It is now high time for a planned, provident approach to tackle this often-neglected problem smartly by leveraging technology.

Why is cash pairing a problem?

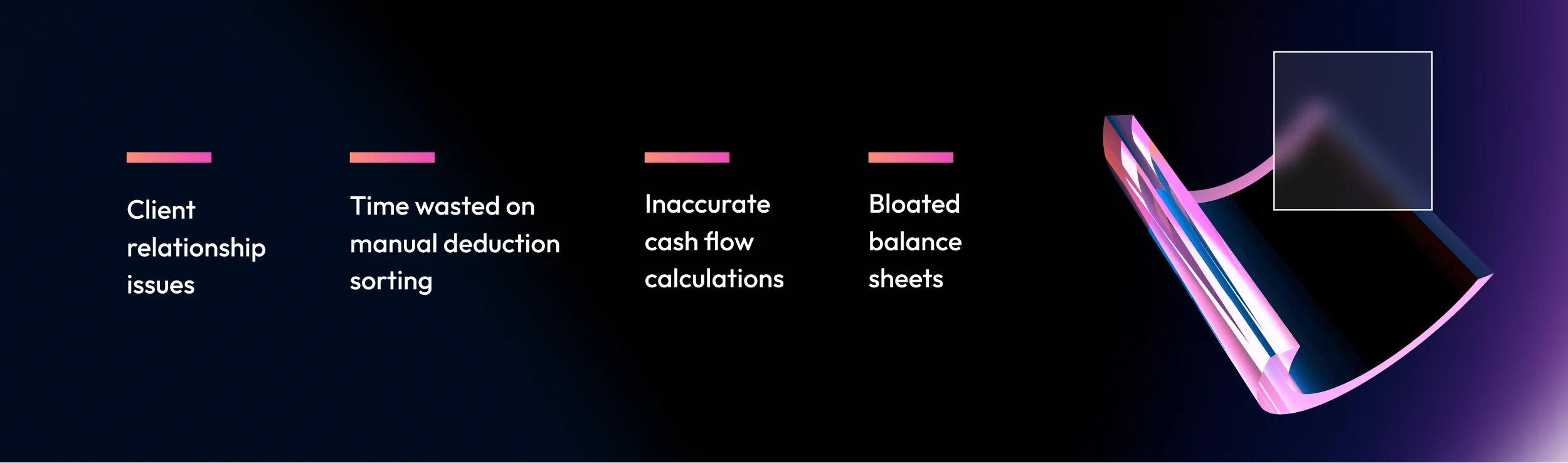

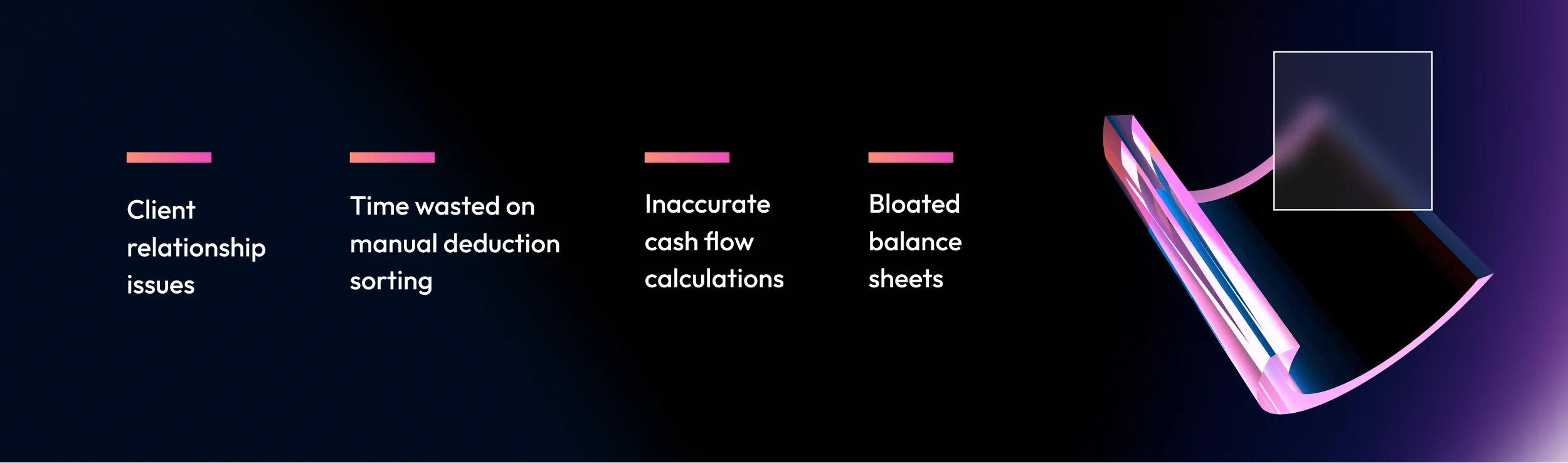

Figure 1. Overview of the problems of cash pairing

Reconciliation of cash receipts with premium receivables is effort-intensive transactional accounting work, complicated by cash clearing and settlement practices in the reinsurance industry. Reinsurers have long struggled to figure out how to reduce the burden placed on their accounting teams associated with these cash clearing and settlement practices, which can be summarised as follows:

- Lack of transparency: Brokers inform reinsurers of the cash transfers to their bank accounts via email, lacking adequate supporting documentation detailing the premiums paid, such as account statements. This results in time-consuming and cumbersome cash reconciliation, as reinsurance accounting teams must manually construct virtual account statements to clear and settle the cash.

- Aggregation of premiums: Reinsurers receive bundled cash comprising premiums for multiple reinsurance contracts. To correctly reconcile cash receipts, these bundled cash amounts must be unpacked and paired to individual reinsurance contracts for which premiums are due.

- Netting of multiple financial obligations from cash receipts: Cash received by reinsurers is net of claims, taxes, commissions, endorsements, and other financial obligations, which are deducted from the contractually agreed premiums. In the absence of adequate supporting documentation, to pair the cash receipts with the expected receivables, the reinsurers’ accounting teams must identify each deducted item to calculate the actual premium amounts due.

These complications often lead to exponential growth of unpaired, unreconciled cash when not adequately managed. Unpaired cash volumes could also easily spiral out of control and become unmanageable during periods of change involving business transformations, such as legacy system transitions, mergers, and business combinations.

Consequences of ineffective cash clearing and settlement management

Figure 2. Overview of the problems of cash pairing

One ultimately needs to ask the question: “What are the consequences to reinsurers of not effectively managing their cash clearing and settlement process?” Here are several operational and treasury issues that may arise when this process is not proactively managed:

- Unpaired cash often results in client relationship issues. It makes it difficult to promptly identify unpaid premiums or differences between expected and received premiums, delaying issue resolution. Imagine having to follow up on receivables issues a year later than they should have been settled – no reinsured would appreciate this! As such, unresolved discrepancies are often written off, creating regulatory issues due to internal control failures at the reinsurer.

- Brokers often lack transparency in providing adequate information for cash transfers to the reinsurer’s bank accounts. This forces reinsurers' accounting teams to spend extra time manually sorting through deductions from premiums, diverting resources from more valuable tasks. To compound this problem: claims netted from receivables may not be timely identified, sometimes forcing reinsurers to accept claims as reported by the insurance companies, forgoing their right to recourse in case of disputes.

- Unallocated cash prevents the clearance of receivables from the balance sheet, impacting accurate cash flow calculations and affecting downstream cash management and working capital financing.

- Drag on solvency capital. Unmatched cash and open receivable balances create bloated balance sheets, requiring the allocation of valuable capital resources.

Smart automation is the key to solving this chronic cash pairing problem.

How our automated solution can help you

We at Synpulse recognise that automating these reconciliations is the solution. With support from our tech powerhouse, Synpulse8, we offer a cost-effective and versatile software product to tackle this problem for reinsurers.

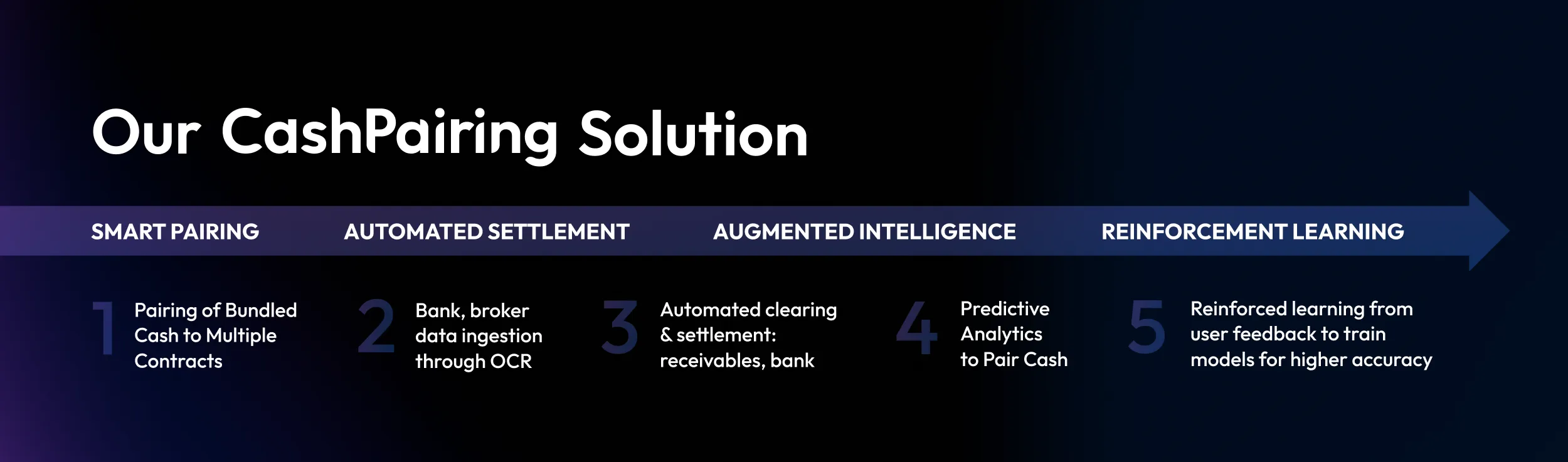

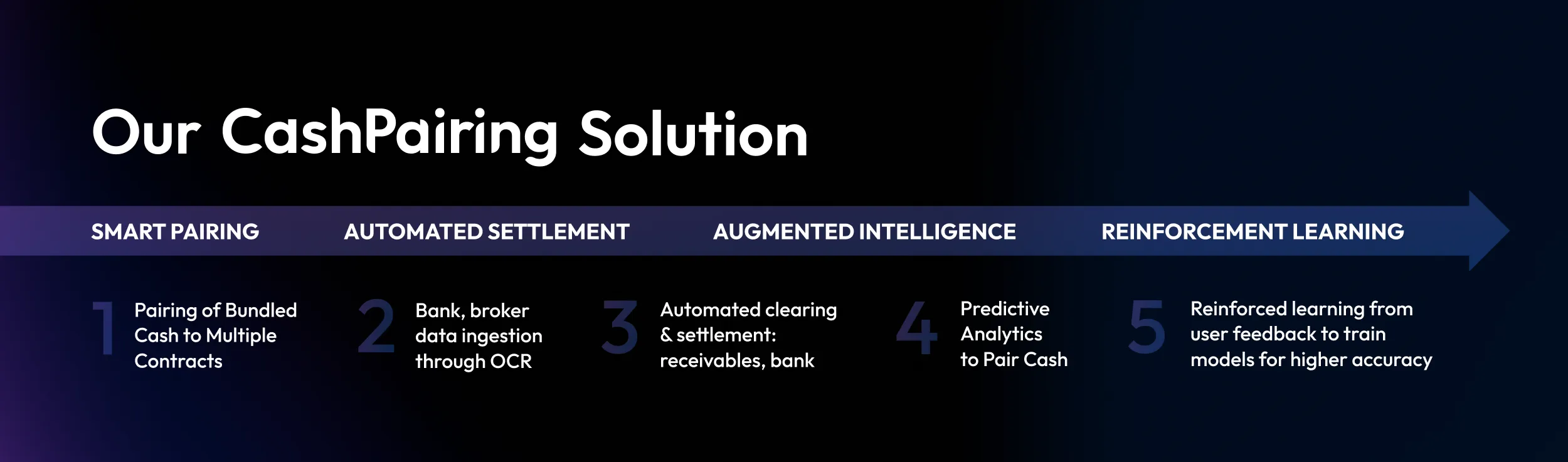

Figure 3. Summary of the key capabilities of Synpulse8’s automated Cash Pairing solutuin

To solve this cash clearing and settlement conundrum, here are the key capabilities of our product:

- We employ predictive analytics, utilising our robust business rule libraries compiled over many years of hands-on technical accounting experience. This allows us to tackle the most complex reconciliation cases, providing insightful analytics to reinsurance administration teams, and drastically reducing time and costs associated with cash pairing.

- Our product automatically constructs digital statements of accounts (virtual bordereaux), unpacking incoming net cash into the relevant reinsurance cash flow components, such as premiums, claims, endorsements, taxes, exchange rate differences, and other deductions. It efficiently allocates bundled cash across multiple reinsurance contracts.

- The collaboration feature of our solution allows multiple users from accounting, claims, and operational finance to review and edit the virtual bordereaux reconciliations, ensuring 100% accuracy.

- We offer flexible, cost-efficient platforms that enable reinsurance administration teams to continuously update their platform capabilities. This keeps our solution ahead of changing market practices in reinsurance transaction settlement.

- No business is static. Our Cash Pairing solution continuously adapts to evolving reinsurers' business needs through reinforced learning. We incorporate a write-back functionality that refines prediction models based on user feedback, enhancing prediction accuracy.

Reinsurers face the daunting task of managing cash receipts and pairing them with premium receivables. This often results in a buildup of unprocessed, unpaired cash on their balance sheets, causing operational headaches. In this article, we explore how our innovative technology-driven smart Cash Pairing solution can tackle these challenges.

Pairing cash with premium receivables promptly and accurately has always been a perennial pain point for reinsurers. When left unattended, the volumes of unpaired cash and corresponding receivable assets can quickly pile up, spiral out of control, and cause a headache for reinsurers.

Timely, accurate settlement of cash receipts, paired with expected premium receivables, stands as a pillar of effective cash management. Yet, reinsurers often struggle to manage this critical aspect, leading all too often to unreconciled and unpaired cash waiting to be processed, piling up on their balance sheets. This causes a plethora of issues, from unsatisfactory customer service to increased scrutiny from regulators. It is now high time for a planned, provident approach to tackle this often-neglected problem smartly by leveraging technology.

Why is cash pairing a problem?

Figure 1. Overview of the problems of cash pairing

Reconciliation of cash receipts with premium receivables is effort-intensive transactional accounting work, complicated by cash clearing and settlement practices in the reinsurance industry. Reinsurers have long struggled to figure out how to reduce the burden placed on their accounting teams associated with these cash clearing and settlement practices, which can be summarised as follows:

- Lack of transparency: Brokers inform reinsurers of the cash transfers to their bank accounts via email, lacking adequate supporting documentation detailing the premiums paid, such as account statements. This results in time-consuming and cumbersome cash reconciliation, as reinsurance accounting teams must manually construct virtual account statements to clear and settle the cash.

- Aggregation of premiums: Reinsurers receive bundled cash comprising premiums for multiple reinsurance contracts. To correctly reconcile cash receipts, these bundled cash amounts must be unpacked and paired to individual reinsurance contracts for which premiums are due.

- Netting of multiple financial obligations from cash receipts: Cash received by reinsurers is net of claims, taxes, commissions, endorsements, and other financial obligations, which are deducted from the contractually agreed premiums. In the absence of adequate supporting documentation, to pair the cash receipts with the expected receivables, the reinsurers’ accounting teams must identify each deducted item to calculate the actual premium amounts due.

These complications often lead to exponential growth of unpaired, unreconciled cash when not adequately managed. Unpaired cash volumes could also easily spiral out of control and become unmanageable during periods of change involving business transformations, such as legacy system transitions, mergers, and business combinations.

Consequences of ineffective cash clearing and settlement management

Figure 2. Overview of the problems of cash pairing

One ultimately needs to ask the question: “What are the consequences to reinsurers of not effectively managing their cash clearing and settlement process?” Here are several operational and treasury issues that may arise when this process is not proactively managed:

- Unpaired cash often results in client relationship issues. It makes it difficult to promptly identify unpaid premiums or differences between expected and received premiums, delaying issue resolution. Imagine having to follow up on receivables issues a year later than they should have been settled – no reinsured would appreciate this! As such, unresolved discrepancies are often written off, creating regulatory issues due to internal control failures at the reinsurer.

- Brokers often lack transparency in providing adequate information for cash transfers to the reinsurer’s bank accounts. This forces reinsurers' accounting teams to spend extra time manually sorting through deductions from premiums, diverting resources from more valuable tasks. To compound this problem: claims netted from receivables may not be timely identified, sometimes forcing reinsurers to accept claims as reported by the insurance companies, forgoing their right to recourse in case of disputes.

- Unallocated cash prevents the clearance of receivables from the balance sheet, impacting accurate cash flow calculations and affecting downstream cash management and working capital financing.

- Drag on solvency capital. Unmatched cash and open receivable balances create bloated balance sheets, requiring the allocation of valuable capital resources.

Smart automation is the key to solving this chronic cash pairing problem.

How our automated solution can help you

We at Synpulse recognise that automating these reconciliations is the solution. With support from our tech powerhouse, Synpulse8, we offer a cost-effective and versatile software product to tackle this problem for reinsurers.

Figure 3. Summary of the key capabilities of Synpulse8’s automated Cash Pairing solutuin

To solve this cash clearing and settlement conundrum, here are the key capabilities of our product:

- We employ predictive analytics, utilising our robust business rule libraries compiled over many years of hands-on technical accounting experience. This allows us to tackle the most complex reconciliation cases, providing insightful analytics to reinsurance administration teams, and drastically reducing time and costs associated with cash pairing.

- Our product automatically constructs digital statements of accounts (virtual bordereaux), unpacking incoming net cash into the relevant reinsurance cash flow components, such as premiums, claims, endorsements, taxes, exchange rate differences, and other deductions. It efficiently allocates bundled cash across multiple reinsurance contracts.

- The collaboration feature of our solution allows multiple users from accounting, claims, and operational finance to review and edit the virtual bordereaux reconciliations, ensuring 100% accuracy.

- We offer flexible, cost-efficient platforms that enable reinsurance administration teams to continuously update their platform capabilities. This keeps our solution ahead of changing market practices in reinsurance transaction settlement.

- No business is static. Our Cash Pairing solution continuously adapts to evolving reinsurers' business needs through reinforced learning. We incorporate a write-back functionality that refines prediction models based on user feedback, enhancing prediction accuracy.